Military Travel Hacking & Your Credit

Every AD servicemember and their spouse qualifies for having their annual fee’s waived through the MLA or SCRA but you still need to be able to qualify for each individual card. Before you start, take some time to make sure your finances are in check.

Your First Card

If you are looking to open your first card and you don’t have any credit established, you’ll want to start with a no fee credit card. You are NEVER going to close this card, so that’s why you want it to be free. USAA and almost every bank offers a starter card. Once you open your card be sure to set up Auto-Pay. This card will not have a lot of benefits but will help you establish great credit so you can be approved for all of the different cards you’re interested in. When you open your card, they are looking to make sure you are consistently paying on your card and how much of your credit limit you are utilizing, try to stay under 30% and every quarter or so check to see if you qualify to have your credit limit increased.

Credit School

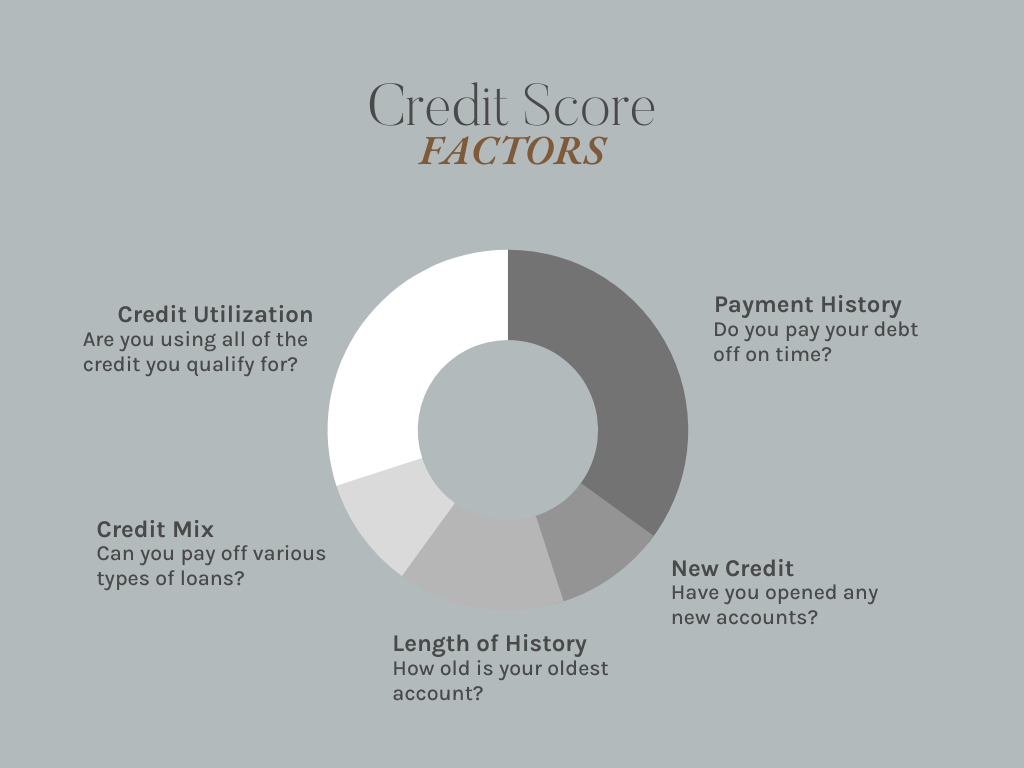

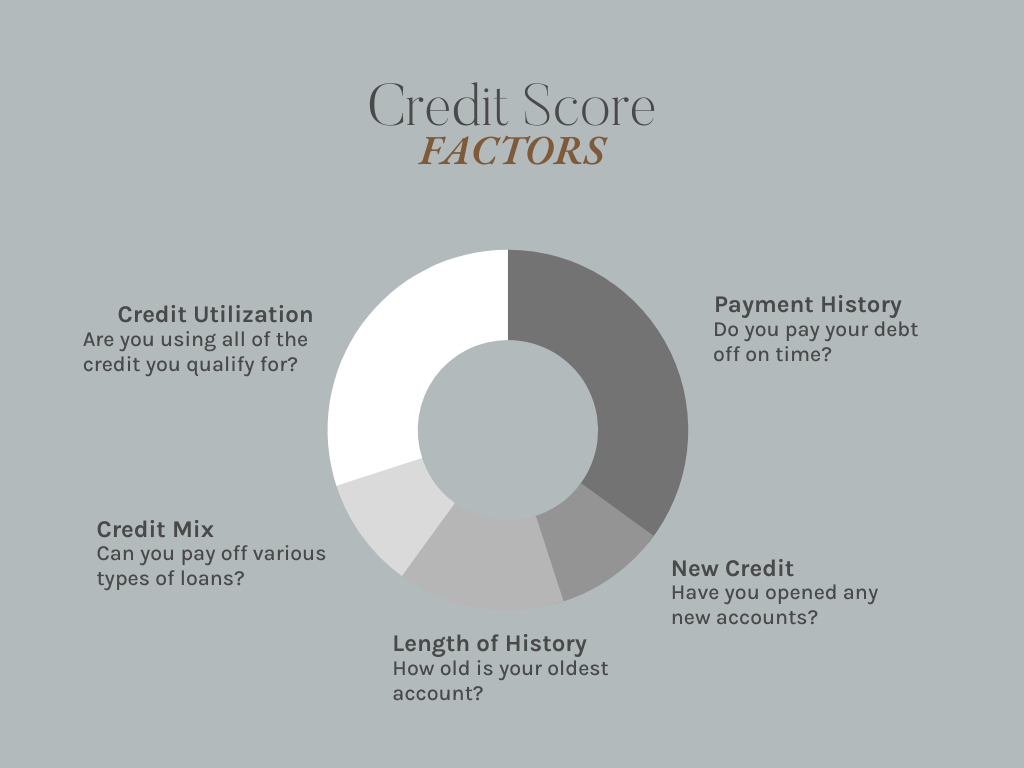

Your credit score is based off five factors which each contribute a different percentage to your overall score. The most important factor is payment history, so make sure your payments are made on time. The best thing you can do is use your credit card just like you would a debit card. Only make purchases that you can pay off in full right now. If you are paying interest or late fees, your rewards and benefits will not be free.

Credit Utilization

The next largest component is Credit Utilization, how much of your available credit you are using. I try to not use more than 30% of my credit limit. So, if your limit were $1,000, you would want to keep your balance under $300. I often pay my card down before the end of the statement period that way I can earn points on more than $300 a month without disrupting my credit utilization. As your credit limit increases or you open more cards, it will be easier to have a great credit utilization score.

Length of History

Then you have the length of credit history, which is how long an account has been open and if you are using it. This is why I would open a no fee card first and you never want to close that card. My husbands’ oldest card is with USAA. We use it to pay our monthly insurance and then have it set up for autopay. This way we are putting a charge on it every month and paying it off, completely automated.

Credit Mix

Credit mix is 10% of your score and they just want to see that you can manage different types of credit. Examples of this is include a mortgage, car loan or other installment loan, charge cards and credit cards. I wouldn’t go getting a loan if you don’t need one or not paying your loan off, just to improve your credit mix. You can have a great score without having a large mix.

New Credit

New credit, which includes your inquiries, is also 10% of your score. This is where the concern that travel hacking will hurt your credit score comes from. For a healthy credit score, they want to make sure you aren’t opening a large amount of debt all at one time.

When you apply for a credit card they check your credit score, which is called an inquiry. This also happens when you are shopping for a home loan or a car loan. You will see a small dip in your score that will bounce back after a month or two. The points you drop depends on how solid your other factors are. Since it is only worth 10% of our credit score, I would only be worried if we are close to buying a home or another type of loan. Travel hacking can help you increase your score by lowering your credit utilization and improving your credit mix.

Credit Score Goals

Many cards require a credit score above 700 and the best cards need 750+ for approval. Managing your payments and credit utilization is important (65% of your score) to be able to continue opening cards and maintain an excellent score. Make sure you stay organized. Check out this organizer for help. Automate everything you can! Then just make sure you are logging into your accounts to verify everything twice a month, so you know if there is a problem before it is time to pay.

If you are unsure what your credit score is, you can pull your credit report for free once a year. Chase and Amex have pages on their apps where you can track your credit score and set up notifications for any changes.